- This event has passed.

Title

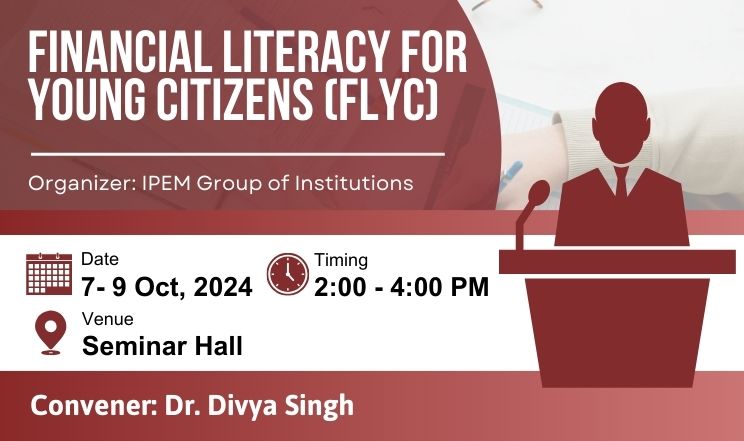

Financial Literacy for Young Citizens (FLYC)

Objective

1. Raise Awareness: Increase awareness of financial literacy among young individuals.

2. Understand Financial Basics: Help students grasp fundamental financial concepts and planning.

3. Develop Critical Thinking: Foster analytical skills for informed financial decision-making.

4. Evaluate Options and Risks: Empower participants to assess financial options and evaluate

associated risks.

5. Explore Investment Opportunities: Provide insights into various investment options and

strategies.

6. Build Confidence: Instill confidence in managing personal finances effectively.

7. Encourage Long-Term Goals: Promote the development of long-term financial goals and

strategies for achieving them.

Description

On October 7th, 2024, IPEM Group of Institutes, Ghaziabad, under the aegis of IQAC and IIC, in

collaboration with NISM and Aditya Birla Capital, organized a 10-hour workshop on “Financial

Literacy for Young Citizens (FLYC).” Financial literacy involves understanding and effectively using

various financial skills, including personal financial management, budgeting, and investing. This

initiative empowers young citizens to manage their finances effectively, make informed decisions,

and secure their economic future.

Important factors encompass understanding:

1. Financial Planning and Savings Strategies

2. Investment Insights and Risk Mitigation

3. Credit Building and Debt Optimization

Financial literacy provides an edge in creating budgets and financial plans, tracking expenses, and

investing wisely. This program targets teenagers and young adults. The earlier you start to become

financially literate, the better off you will be, as education is the key to a successful financial future.

The resource person for the workshop was Mr. Chandresh Gupta (SEBI & NISM, Corporate Trainer).

Conveners

Dr. Divya Singh

Highlights